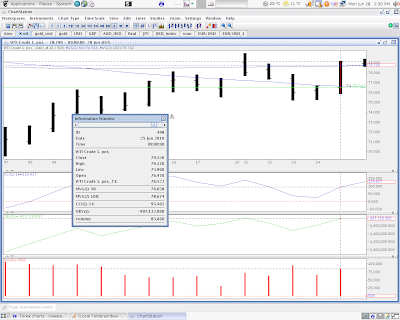

Asia hit out first with a massive bout of intervention on Thursday 11th 2010 with US and European central banks/goverments backing it up, we now have a market correction that has gone in reverse (markets at this point were not oversold).

The Central Bank intervention and goverment rhetoric started on the May 20th 2010 refer to:

A Foreign Exchange (FX) trading war about to erupt between Central Banks and Hedge Funds

Amazing Central bank intervention (FX markets)China:

The rumors of 50% export surge was then downgraded to the 48.5% this was still a primer for market risk appetite and equity rallies maintained on the trade surplus (after a trade deficit in April 2010 at $7.2 BillionUS)

China sovereign find talks up the EUR , even though China's sovereign fund took a 10% loss on it's China helps in EU zone. PBoC (Peoples Bank of China) agrees to extend a currency swap with the Chinese Yuan and Icelandic Crowns. This also buoyed markets and added to equity and currency rallies (EUR and other 'risk currencies')

Conclusion: China is playing a double edge sword. A property bubble and an ecomomy that is possibly showing overcapacity (reports China now is using it's iron ore reserves). It can ramp up or talk up economic growth and try to appease the markets, but at the expense of a growing US trade gap (China cheap imports crushing US exports). Meaning? A trade war is back on the table, mixed with a property speculation bubble. Very FUBAR situation unfolding.

Korea:

Bank of Korea is a big player (intervention) in the FX markets, but now their goverment wants to limit forward contracts of buy/sell on the Korea WON and also restrictions on FX derivatives. A socialistic style of control re: currency fluctuations.

Conclusion: Korea is worried about it's depleting and value losing FX reserves. It's going to run out of ammo come fresh economic crisis.

Japan:

Bank of Japan have been intervening directly into the FX markets in conjunction with other regional central banks, BoJ have bought AUD, sold YEN, bought EUR, sold YEN, bought CAD and sold USD etc etc. Obsessive and Compulsive intervention in the foreign exchange markets

Conclusion: Japan is worried about it's depleting and value losing FX reserves. It is being used by other CB's to intervene in clandestine FX propping operations.

Then there is Europe and the US...

Pretty much there has been a line drawn under the EUR and the DOW (using stock index as an example), the EUR at 1.19/1.20 and the Dow at the psychological 10,000.

Europe and the US haven't got much left in the way of goverment based fiscal intervention (ref: EU deficits/debt crisis), what they do have is their central banks such as the Federal Reserve and the European Central bank and the Bank of England is the power to print money, swap currency's on low interest rates (particularly the US Fed flowing US dollars into Europe via currency swaps), buying government bonds (such as the ECB/FED are doing) or sovereign debt. The other thing they have is verbal rhetoric in conjunction with government talk, which has a stabilizing effect (very short term) on the markets. A good example is Germany and France, with that French midget Nicolas Sarkozy and that German woman Angela Merkel obsessively trying to impose restrictions on short selling (which will be across the board). So far they have written a

letter outlining this, whether it comes into play will be disputable, but they have both inked out a communistic style support of 'weak' assets ( as short selling cleans out the financial system of weak, corrupt assets ref: Enron, BP etc etc)

So currently there is a lot of asset support in EU and US markets, whether much liquidity is behind this is disputable. But regardless verbal support/rhetoric from central banks is doing the trick on the short end.

Conclusion: Europe and US are screwed. Desperate measures and rushed policies of asset support (everything) means one thing. The end is near.